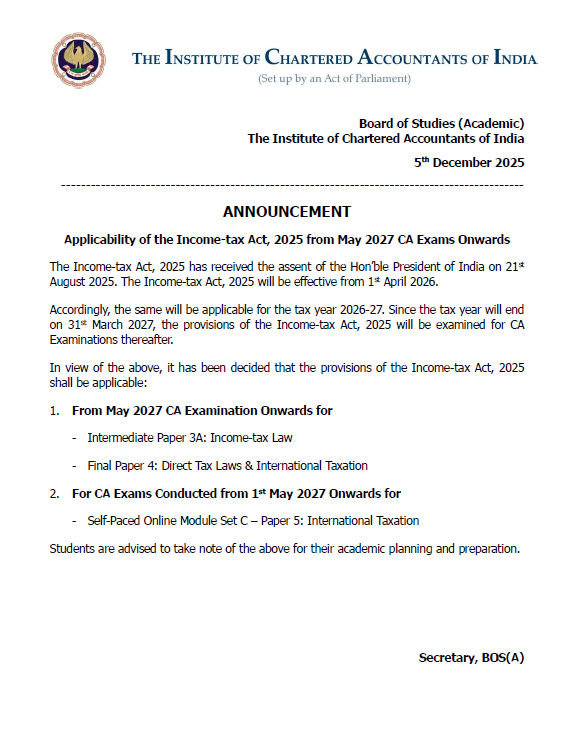

The Institute of Chartered Accountants of India (ICAI) has released an important announcement dated 5 December 2025 regarding the applicability of the Income-tax Act, 2025 in CA examinations. This update is highly relevant for CA Intermediate and CA Final students preparing for 2026 and 2027 attempts.

This article provides a clear, simplified explanation of the notification and how it applies under the new three-attempt exam cycle (January, May/June, September).

📌 Summary of the ICAI Notification

As per the official notification issued by ICAI (BOS-A) 89799bos-announcement-income-ta…:

- The Income-tax Act, 2025 received Presidential assent on 21 August 2025.

- The Act becomes effective from 1 April 2026.

- It applies for the tax year 2026–27.

- Since this tax year ends on 31 March 2027, ICAI will examine the new law only in exams conducted after that date.

🔔 Therefore, the new Income-tax Act, 2025 will be applicable from the May/June 2027 attempt onwards.

This is the official and final applicability.

📚 Applicability Under the New 3-Exam Pattern

ICAI now conducts CA exams three times a year. With this structure, the applicability of the Income-tax Act, 2025 becomes:

| Attempt | Law Applicable |

|---|---|

| January 2026 | Income-tax Act, 1961 |

| May/June 2026 | Income-tax Act, 1961 |

| September 2026 | Income-tax Act, 1961 |

| January 2027 | Income-tax Act, 1961 |

| May/June 2027 | Income-tax Act, 2025 (NEW) |

| September 2027 | Income-tax Act, 2025 |

| January 2028 | Income-tax Act, 2025 |

✔ First exam with new Income-tax Act, 2025: May/June 2027

📘 Papers Where the New Act Will Apply

According to the notification 89799bos-announcement-income-ta…, the following papers will now be based on the Income-tax Act, 2025 from May 2027 onwards:

CA Intermediate

- Paper 3A – Income-tax Law

CA Final

- Paper 4 – Direct Tax Laws & International Taxation

Self-Paced Online Modules

- Set C – Paper 5: International Taxation

(Applicable from 1 May 2027 exam session onward)

📅 Why May/June 2027 Is the First Applicable Attempt

The logic is straightforward:

- New Act effective: 1 April 2026

- Applicable to tax year: 2026–27

- Tax year ends: 31 March 2027

- ICAI examines last completed tax year

- Next exam after 31 March 2027 = May/June 2027 attempt

Thus, May/June 2027 is the first logical and official attempt.

🎯 What This Means for Students

If you are preparing for exams in 2026 (Jan, May/June, Sept):

✔ Continue studying Income-tax Act, 1961

✔ No syllabus change for Direct Tax or International Taxation

If you are preparing for 2027 exams:

✔ Expect transition to Income-tax Act, 2025

✔ ICAI will release updated:

- Study Material

- Case Laws & MCQs

- RTPs/MTPs

- Practice Questions

✔ Begin familiarising yourself with the new structure once ICAI uploads study material.

📝 Conclusion

The new Income-tax Act, 2025 marks a major shift in India’s direct tax framework. ICAI has ensured a smooth and student-friendly transition by applying the law only from May/June 2027 onwards, giving students sufficient time to prepare.

In short:

👉 All exams till January 2027 follow the Income-tax Act, 1961

👉 All exams from May/June 2027 onwards follow the Income-tax Act, 2025

This clarity helps CA aspirants plan their preparation confidently and avoid confusion caused by unofficial sources.

Leave a comment