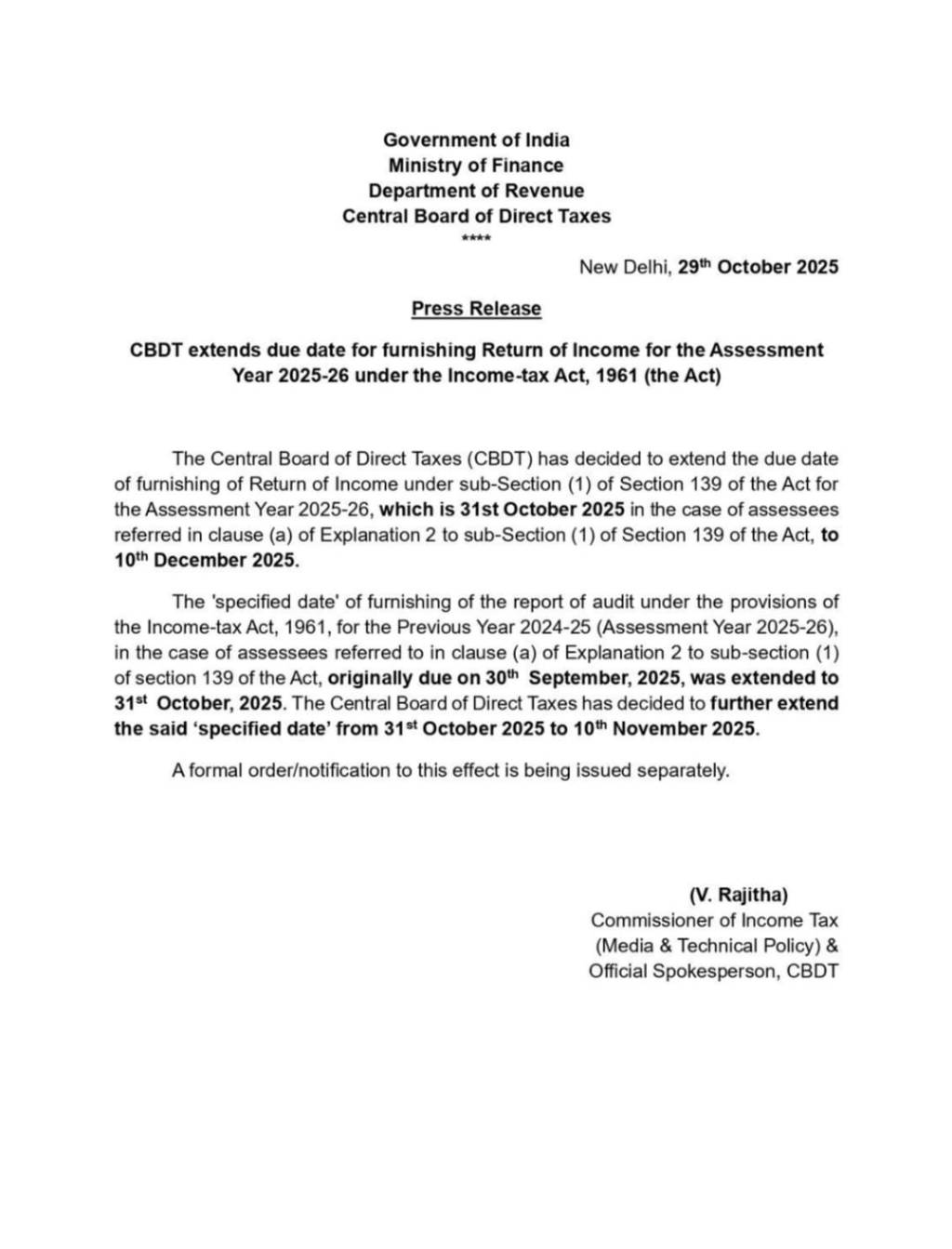

New Delhi, 29th October 2025:

The Central Board of Direct Taxes (CBDT) has officially extended the due dates for furnishing the Return of Income and Tax Audit Report for the Assessment Year (AY) 2025–26 under the Income-tax Act, 1961.

Revised Deadlines

- Tax Audit Report (Form 3CA/3CB/3CD):

The due date, which was previously extended to 31st October 2025, has now been further extended to 10th November 2025. - Income Tax Return (ITR) Filing (for audited taxpayers):

The due date for furnishing the ITR under Section 139(1) has been extended from 31st October 2025 to 10th December 2025.

This extension comes as a major relief to taxpayers, tax professionals, and audit firms who have been facing challenges in completing audits and filings within the earlier timelines.

Background

The original due dates under the Income-tax Act were:

- 30th September 2025 for furnishing the Tax Audit Report.

- 31st October 2025 for filing the Return of Income for taxpayers requiring audit.

However, considering the practical difficulties faced by stakeholders, CBDT extended the audit report deadline to 31st October 2025 earlier. With the present notification, the Board has now granted an additional 10 days for audit report submission and 40 days for ITR filing.

CBDT’s Clarification

CBDT, through its press release dated 29th October 2025, stated that a formal order/notification to this effect will be issued separately. The extension is applicable to all assessees covered under clause (a) of Explanation 2 to Section 139(1) of the Income-tax Act, i.e., those required to get their accounts audited.

Impact of the Extension

This move is expected to:

- Ease the compliance burden for tax practitioners during the busy filing season.

- Allow better accuracy and quality in tax filings.

- Provide breathing space for corporates and firms dealing with multiple audits.

Key Dates at a Glance

| Particulars | Original Due Date | Earlier Extended Date | New Extended Date |

|---|---|---|---|

| Tax Audit Report (AY 2025–26) | 30th September 2025 | 31st October 2025 | 10th November 2025 |

| ITR Filing (for Audited Assessees) | 31st October 2025 | – | 10th December 2025 |

FAQs

1. Who is eligible for this extension?

All taxpayers who are required to get their accounts audited under Section 44AB of the Income-tax Act are covered.

2. Does this extension apply to non-audit cases?

No. The due date for non-audit cases (individual taxpayers, small businesses not subject to audit) remains 31st July 2025.

3. Will the interest under Sections 234A, 234B, and 234C apply for delayed filing?

If returns are filed within the newly extended deadline, no additional interest will apply for the extended period.

4. Is a separate notification expected?

Yes, CBDT has confirmed that a formal notification/order will be issued shortly to give legal effect to this extension.

Leave a comment