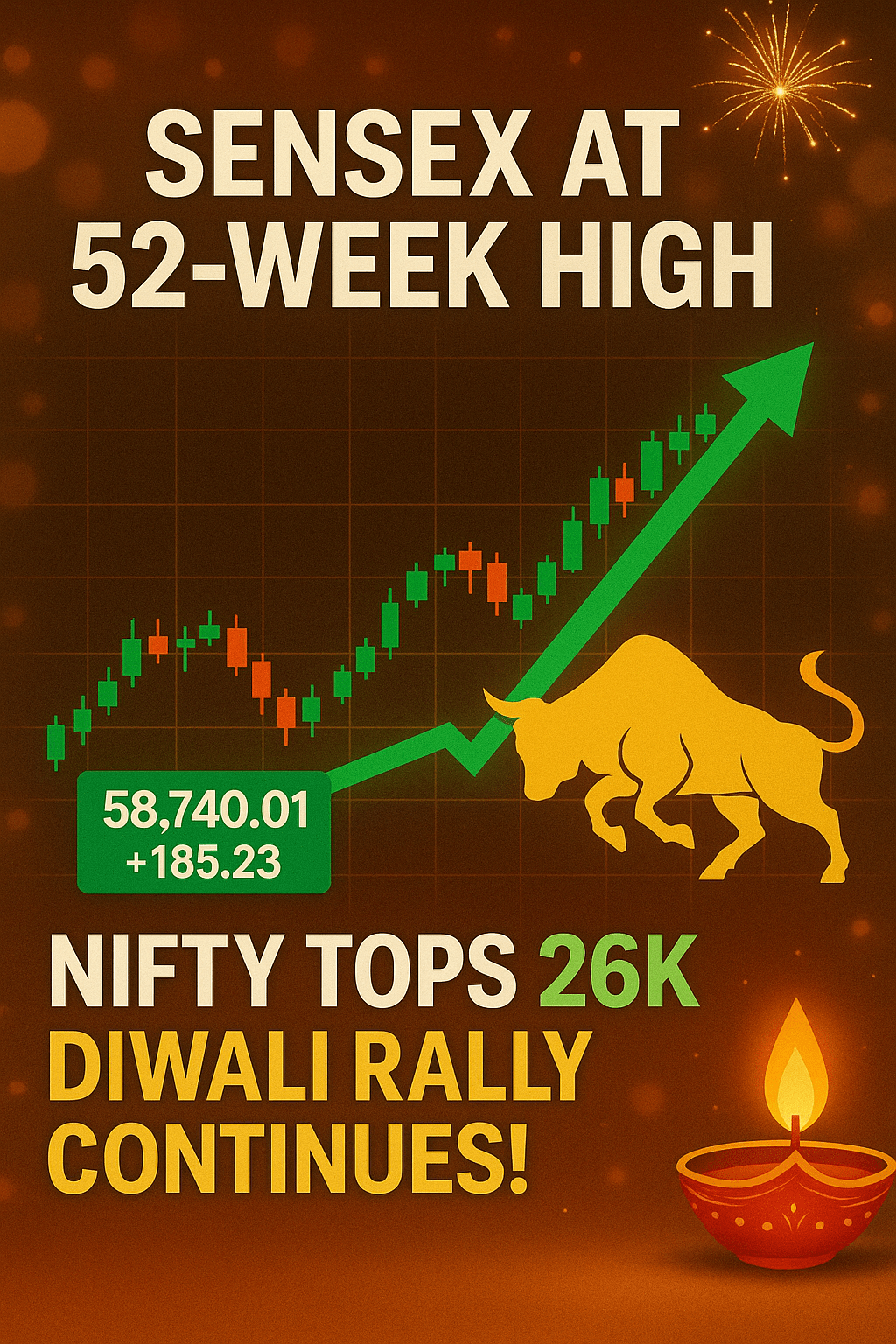

The festive spirit continues on Dalal Street! Indian stock markets extended their post-Diwali rally today, with the Sensex closing near its 52-week high and the Nifty crossing the historic 26,000 mark for the first time. Investor sentiment remains upbeat, driven by strong earnings, healthy FII inflows, and a surge in festive demand.

Here’s a breakdown of the 5 key factors that fueled today’s spectacular rally:

1️⃣ FIIs Turn Aggressively Positive

Foreign Institutional Investors (FIIs) have turned net buyers again, pouring over ₹6,000 crore into Indian equities this month.

The weakening US dollar and hopes of a global rate cut cycle have boosted investor appetite for emerging markets — with India at the top of the list.

This renewed foreign confidence signals that India remains a preferred investment destination amid global uncertainty.

2️⃣ Strong Q2 Earnings Season

Corporate India has delivered an impressive Q2FY26 earnings season.

Leading sectors like banking, IT, and automobiles reported double-digit profit growth, supported by robust credit demand and operational efficiencies.

Even sectors like FMCG and energy displayed stability, reinforcing overall market optimism.

3️⃣ Festive Demand Boost

The festive period — led by Diwali, Dussehra, and Navratri — has driven a surge in consumer spending.

Auto and jewelry sales touched new highs, while retail and e-commerce also saw record demand.

This strong consumption trend highlights the resilience of India’s domestic economy despite global headwinds.

4️⃣ Global Cues Turn Supportive

Global markets turned favorable as crude oil prices softened and inflation data in the US and Europe eased.

The possibility of interest rate cuts in early 2026 has added to investor optimism.

These global tailwinds have made equities — especially Indian ones — even more attractive.

5️⃣ Technical Breakout & Retail Participation

Technically, the Nifty’s breakout above 26,000 has sparked a fresh wave of bullish sentiment.

Domestic investors are continuing their buying spree, with SIP inflows crossing ₹20,000 crore in October — a record high.

This consistent retail and mutual fund participation is providing strong market support even during profit-booking phases.

📊 Market Snapshot

- Sensex: 85,740 ▲ +620 points (+0.72%)

- Nifty 50: 26,015 ▲ +180 points (+0.70%)

- Bank Nifty: 56,500 ▲ +1.1%

- Top Gainers: HDFC Bank, Maruti Suzuki, Infosys, Titan

- Sectoral Leaders: Auto, IT, Financials

📈 What Should Investors Do Now?

Experts advise investors to stay invested and focus on fundamentally strong stocks.

Short-term volatility may continue, but India’s long-term growth story remains intact.

Sectors like banking, infrastructure, manufacturing, and consumption are expected to remain in focus for the next few quarters.

💬 “With domestic liquidity strong and earnings momentum intact, the rally could sustain well into the next calendar year,” said a leading market strategist.

📌 FAQs: Market Rally & Nifty 26K Milestone

Q1. Why did the Sensex and Nifty rise so sharply after Diwali?

A: The rise was driven by festive demand, strong Q2 earnings, FII buying, and positive global cues — all contributing to bullish momentum.

Q2. Is it a good time to invest in the stock market now?

A: Experts suggest continuing SIPs and staying invested in quality large-cap and sectoral leaders rather than chasing short-term gains.

Q3. Will the rally sustain or is a correction expected?

A: Minor corrections may happen, but strong domestic inflows and economic fundamentals could support the market in the near term.

Q4. Which sectors are leading the current market rally?

A: Banking, IT, Auto, and Consumption sectors are driving the market higher, supported by robust earnings and festive sales.

Q5. What level can Nifty target next?

A: Analysts are eyeing the 26,300–26,500 range as the next resistance zone, with support around 25,700.

✨ Bottom Line

The Diwali glow is still shining bright on Dalal Street!

With strong earnings, healthy inflows, and robust festive momentum, India’s equity market is set to remain on an upward trajectory.

For investors, this festive rally could be just the beginning of another prosperous chapter in the markets.

Leave a comment