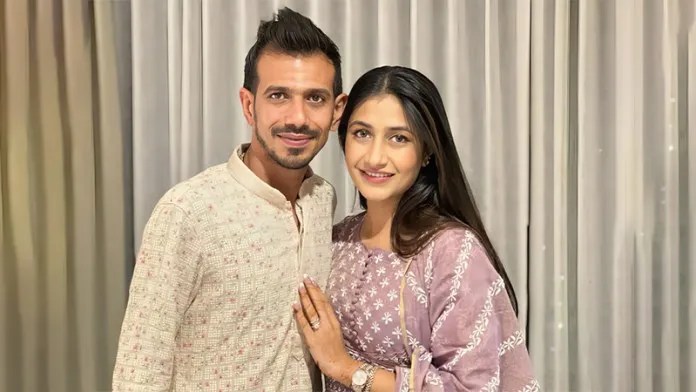

Breaking Buzz: Social media is on fire with chatter about Yuzvendra Chahal facing income tax scrutiny. The question on everyone’s mind is, is Chahal in tax trouble? While there’s no official confirmation, this has reignited the conversation around digital income and tax compliance. Influencers and digital creators are learning that the tax landscape is changing rapidly, and they must stay informed to avoid pitfalls.

If you’re an influencer, YouTuber, gamer, or sportsperson—this is your wake-up call to understand the intricacies of tax laws that apply to your digital earnings. The rise of social media has created dynamic income streams, but it also comes with responsibilities.

What’s Going On? Rumors suggest Chahal may have failed to declare certain sponsorship or prize incomes. Whether true or not, it highlights a significant reality: The Income Tax Department is watching digital earners. As the digital economy expands, tax authorities are adapting their approaches to ensure compliance from all earners, making it crucial for influencers to maintain transparency. Understanding the question is Chahal in tax trouble? can serve as a wake-up call for many.

Understanding the Implications: Is Chahal in Tax Trouble?

Who’s At Risk? The risk extends beyond just cricketers like Chahal. Anyone engaged in the digital space must be aware.

- Instagram & YouTube influencers

- Twitch streamers & gamers

- Professional athletes & cricketers

- Freelancers earning through brand deals or barter

- Anyone receiving free gifts or products

For example, a popular YouTube influencer who received sponsored equipment worth ₹60,000 must declare that as income. Not doing so can lead to hefty fines and penalties.

Consider Twitch streamers who earn from subscriptions and donations. They need to track every bit of income earned, regardless of how small, to remain compliant with tax regulations.

Professional athletes should also be mindful, especially when signing endorsement deals that could lead to substantial income. Transparency and proper documentation are essential for these athletes to avoid complications.

Freelancers earning through brand deals or barter arrangements must keep meticulous records of their income and expenses. Even gifts received during promotional events should be documented as they can be taxable.

Anyone receiving free gifts or products, such as beauty products for reviews, should also declare their value, as it counts towards total earnings.

Top 3 Mistakes You Might Be Making: Understanding common pitfalls can help prevent serious tax issues.

- Not declaring freebies & barters (above ₹50,000/year? It’s taxable!)

- Skipping GST if your income > ₹20L/year

- Not paying advance tax – especially if earning irregularly

Quick Fix Checklist: Use this checklist to get your finances in order and avoid issues down the line.

- Declare all income – even free trips, iPhones, or crypto airdrops

- File correct ITR (usually ITR-3 or ITR-4)

- Get GST-registered if needed

- Keep proofs (invoices, emails, contracts)

- Hire a CA if income > ₹10L

Why This Matters NOW: FY 2024-25 is under tighter surveillance. The IT Department uses AI to match your social media life with actual returns. One mismatch — boom, notice issued. With digital platforms growing, the scrutiny will only increase, making it essential for all digital earners to adhere strictly to tax laws.

Leave a comment