1. Introduction

In continuation of its endeavour to simplify and rationalize the classification and tax treatment of components in the electronics manufacturing sector, the Central Board of Indirect Taxes and Customs (CBIC) issued Circular No. 08/2025-Customs dated 24th March 2025. This Circular provides long-awaited clarity on the scope and classification of camera modules used in the manufacture of cellular mobile phones under Notification No. 57/2017-Customs dated 30.06.2017, especially in light of the recent interpretations by investigative authorities and evolving industry practices.

The circular becomes critical in the backdrop of the fast-evolving mobile phone ecosystem, the increasing integration of components, and attempts by manufacturers and importers to align their import strategies with concessional duty structures.

2. Legal Background

2.1 Relevant Notifications and Entries

- Entry No. 5A of Notification No. 57/2017-Customs:

Prescribes a concessional Basic Customs Duty (BCD) rate of 10% on camera modules for use in the manufacture of cellular mobile phones. - Entries 6B and 6BA of the same notification:

Provide full exemption from BCD on inputs or parts, including camera lens or sub-parts, used in the manufacture of camera modules.

While these entries have been in force since 2017, ambiguities persisted around what precisely constitutes a “camera module”, especially in cases involving complex, integrated imports.

3. Trigger for the Clarification

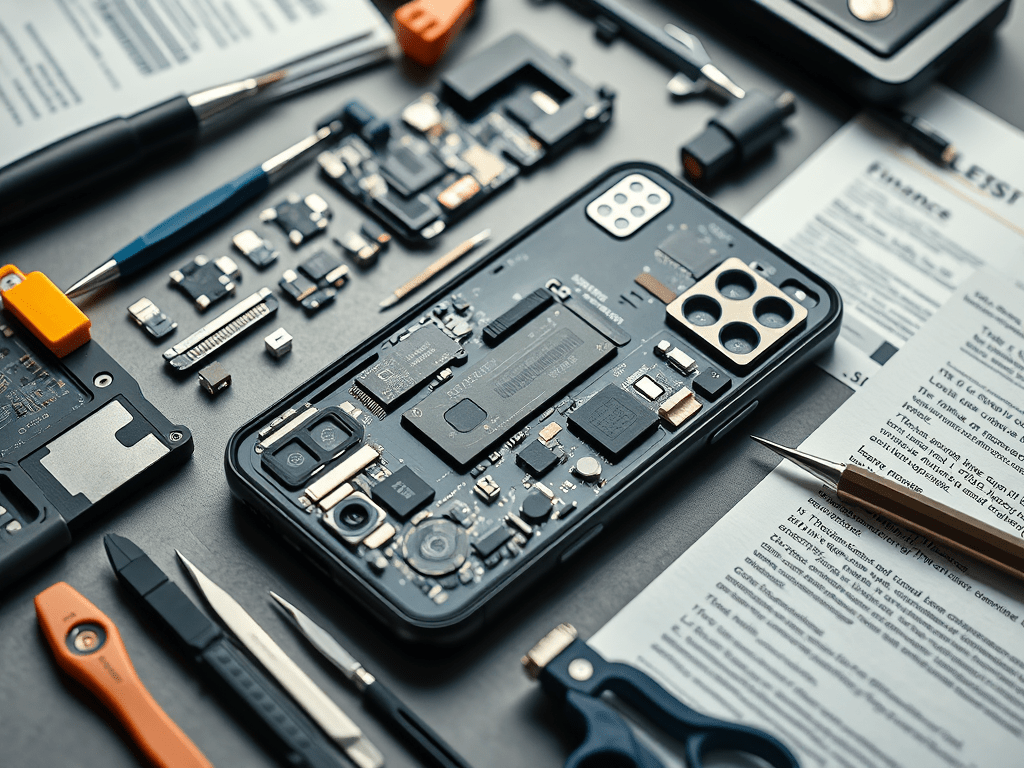

An investigation by the Directorate of Revenue Intelligence (DRI) highlighted inconsistencies in interpretation. Import consignments often contained camera modules pre-fitted into a metal chassis, with associated parts such as flexible printed circuits (FPCs), connectors, and mechanical covers. The key concern was whether such assemblies, which include other structural or mechanical parts, could still enjoy the concessional duty under Entry 5A or be considered separately dutiable components.

The Ministry of Electronics and Information Technology (MeitY) provided crucial input through its Office Memorandum No. W-15/2/2024-IPHW dated 31.12.2024, which helped form the technical foundation for this clarification.

4. Key Clarifications in Circular No. 08/2025

The CBIC’s clarificatory stand revolves around the “essential character” principle under Rule 3(b) of the General Rules for Interpretation (GRI) of the Customs Tariff, which is now to be applied for interpreting what qualifies as a camera module.

4.1 Essential Character Test

- A camera module is defined as a combination of various parts — lens, sensor, FPCB (Flexible Printed Circuit Board) assembly, brackets/holders, connectors, and other mechanical parts — tailored as per specific phone models.

- Where such a combination retains the essential character of a camera, it shall be classified as a camera module, even if it includes supporting parts.

4.2 Permissible Components in Camera Modules

- Assemblies that merely add strength, structural stability, or protection — such as metallic chassis, plastic covers, or brackets — and do not introduce independent functions, will not disqualify the entire unit from being treated as a camera module.

- This aligns with precedents such as the classification of display assemblies where parts that serve structural purposes were accepted within the main component’s classification.

4.3 Singular and Multiple Cameras

- Assemblies with one or more camera units, if designed with integration intent and aligned to mobile phone specifications, are to be treated as camera modules.

4.4 Integrated vs. Individual Import

- Complete assemblies imported as integrated camera modules are eligible for concessional BCD under Entry 5A.

- However, if components are imported individually (e.g., only lens, only sensor), they will be classified and taxed separately as per their respective HSN codes and duty rates.

5. Impact on Stakeholders

5.1 Importers & Manufacturers

- Encourages the import of integrated camera assemblies, streamlining customs compliance.

- Prevents misclassification, litigation, and higher duties arising from fragmented imports.

- Importers must maintain technical documentation and Bill of Materials (BoMs) to substantiate the “essential character” of the imported assembly.

5.2 Supply Chain Optimization

- Helps electronics OEMs (Original Equipment Manufacturers) and EMS (Electronics Manufacturing Services) companies to align procurement and duty planning.

- Customs brokers and supply chain advisors need to be sensitized to the new interpretive approach.

5.3 Customs Administration

- Ensures uniformity in assessment practices and reduces discretion at the field level.

- Empowers assessing officers to apply Rule 3(b) of GRI methodically for classification.

6. Broader Legal and Tax Framework

This clarification aligns with:

- Section 25 of the Customs Act, 1962, which empowers the Government to issue exemption notifications.

- General Rules for Interpretation of the First Schedule of the Customs Tariff Act, 1975.

- Evolving jurisprudence on “essential character”, including CCE v. Phoenix International Ltd. and Sony India Pvt. Ltd. v. Commissioner of Customs, where courts emphasised substance over form in classification matters.

7. Recommendations & Compliance Checklist

| Action Item | Who Should Act |

|---|---|

| Review BoMs and assembly specifications for all camera module imports | OEMs & EMS Companies |

| Restructure imports as integrated assemblies where feasible | Procurement Teams |

| Maintain technical drawings and integration documentation | Customs Consultants |

| Align ERP and HS code mappings for accuracy | IT & Finance Teams |

| Train customs brokers and CHA agents | Logistics Team |

8. Conclusion

CBIC Circular No. 08/2025-Customs marks a pivotal moment in ensuring clarity and consistency in the import ecosystem for the mobile phone industry. It strikes a balance between technological realities and the customs classification framework, promoting ease of doing business without compromising revenue safeguards.

From a tax professional’s lens, this clarification reduces potential exposure to duty demands and penalties under Sections 28 and 111 of the Customs Act, provided the documentation and classification positions are sound.

With the mobile technology sector evolving rapidly, such clarifications are not just helpful — they are essential.

For further consultation or compliance support, feel free to reach out to your Chartered Accountant or Indirect Tax Advisor.

Leave a comment