Introduction

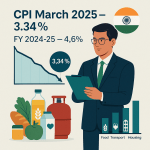

India’s retail inflation, as measured by the Consumer Price Index (CPI), has reached a significant milestone. According to the Press Information Bureau’s release dated April 16, 2025, the CPI for the fiscal year 2024–25 stood at 4.6%, marking the lowest annual inflation rate since 2018–19. Notably, March 2025 witnessed a year-on-year inflation rate of 3.34%, the lowest monthly rate since August 2019.

Understanding the Consumer Price Index (CPI)

The CPI is a critical economic indicator that measures the average change over time in the prices paid by consumers for a basket of goods and services. In India, the National Statistical Office (NSO) under the Ministry of Statistics and Programme Implementation (MoSPI) compiles the CPI, currently using the base year 2012. The CPI encompasses various categories, including food, clothing, housing, fuel, and more, reflecting the cost of living for the average consumer.

Segment-specific indices are also published to cater to different population groups:

- CPI (IW): Consumer Price Index for Industrial Workers

- CPI (AL): Consumer Price Index for Agricultural Labourers

- CPI (RL): Consumer Price Index for Rural Labourers

Key Highlights for March 2025

- Food Inflation: The year-on-year food inflation based on the Consumer Food Price Index (CFPI) stood at 2.69% in March 2025, the lowest since November 2021. This marks a sharp decline of 106 basis points from the previous month.

- Rural Food Inflation: 2.82%

- Urban Food Inflation: 2.48%

- Drivers of Decline: The overall moderation in food prices was led by a drop in inflation across key categories such as vegetables, eggs, pulses and products, meat and fish, cereals and products, and milk and products.

- Rural Inflation: A notable fall was recorded in both headline and food inflation in rural areas.

- Headline Inflation: Fell from 3.79% in February to 3.25% in March

- Food Inflation: Dropped from 4.06% to 2.82%

- Urban Inflation: Headline inflation in urban areas saw a marginal rise to 3.43% in March, up from 3.32% in February. However, food inflation declined significantly from 3.15% to 2.48%.

- Housing Inflation: For the urban sector, housing inflation rose slightly to 3.03% in March 2025 from 2.91% in February.

- Fuel & Light: Inflation in this category rebounded to 1.48% in March from -1.33% in February, covering both rural and urban areas.

- Education Inflation: A moderate increase was noted in education-related inflation, rising to 3.98% from 3.83% the previous month.

- Health Inflation: Prices in the health segment saw a mild rise, with inflation at 4.26% in March, up from 4.12% in February.

- Transport & Communication: Inflation in this category increased to 3.30% in March 2025 compared to 2.93% in February.

- Items with Highest Inflation: In March 2025, the top five items with the highest year-on-year inflation were coconut oil (56.81%), coconut (42.05%), gold (34.09%), silver (31.57%), and grapes (25.55%).

- Items with Lowest Inflation: The items witnessing the steepest decline in prices were ginger (-38.11%), tomato (-34.96%), cauliflower (-25.99%), jeera (-25.86%), and garlic (-25.22%).

Government Measures Contributing to Inflation Control

The government’s strategic interventions have been pivotal in achieving this outcome. Key measures include bolstering buffer stocks of essential food items and releasing them periodically in open markets, alongside subsidised retail sales of staples like rice, wheat flour, pulses, and onions. Simplified import duties on critical food items, stricter stock limits to prevent hoarding, and reduced GST rates on essentials have further eased price pressures. Targeted subsidies, such as LPG support under the Pradhan Mantri Ujjwala Yojana and the Pradhan Mantri Garib Kalyan Anna Yojana, have protected vulnerable households from rising food grain costs, ensuring that the benefits of lower inflation reach those who need it most.

Conclusion

The steady decline in retail inflation over recent years marks a crucial milestone in India’s economic journey, reflecting the success of coordinated efforts by the Government of India. From proactive monetary policies to targeted fiscal measures that safeguard consumers, especially the vulnerable, from volatile price swings, the approach has been both inclusive and effective. With inflation now at its lowest since 2018–19, India has not only reinforced macroeconomic stability but also created an enabling environment for sustainable growth. This trajectory underscores the country’s resilience and commitment to ensuring price stability without compromising on development goals.

For further details, refer to the official press release: PIB Press Release

Leave a comment