Introduction

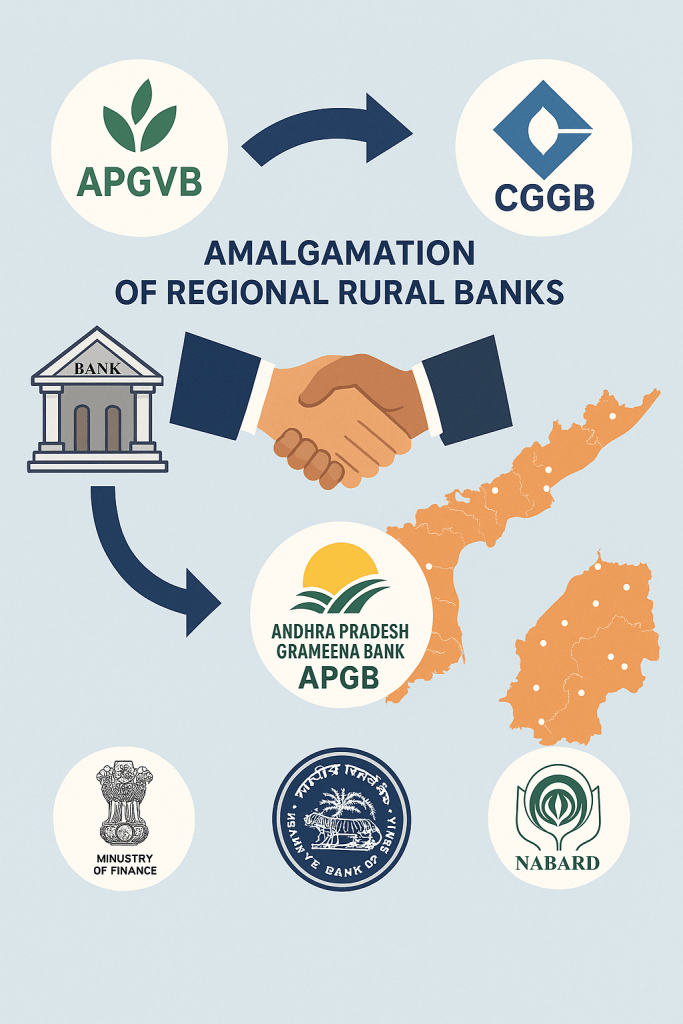

The Indian financial sector continues to undergo structural reforms, particularly in the rural banking landscape. A significant development in this sphere is the Government of India’s notification for the amalgamation of Regional Rural Banks (RRBs). The most recent case, as per the official notification published at apgb.in, involves the merger of Andhra Pradesh Grameena Vikas Bank (APGVB) and Chaitanya Godavari Grameena Bank (CGGB) into the newly formed entity named Andhra Pradesh Grameena Bank (APGB). This article, written from a Chartered Accountant’s perspective, analyses the notification in detail, delving into the regulatory framework, structural implications, and compliance considerations surrounding such amalgamations.

Background and Regulatory Framework

Regional Rural Banks were established under the RRB Act, 1976 with a mandate to promote financial inclusion by catering to the credit needs of rural India. Over time, operational inefficiencies, overlapping geographies, and technology gaps necessitated restructuring.

Legal Basis:

- Section 23A of the RRB Act, 1976 empowers the Central Government to amalgamate two or more RRBs based on recommendations of the sponsor banks and the NABARD.

- The Banking Regulation Act, 1949, as applicable to RRBs, lays down prudential norms and oversight responsibilities.

Recent Merger Notification Dated 29th February 2024:

- The Central Government, in consultation with NABARD, RBI, and sponsor bank State Bank of India (SBI), has approved the amalgamation.

- Effective date of the merger: 1st April 2024

- Name of the new entity: Andhra Pradesh Grameena Bank (APGB)

- Head Office: Warangal, Telangana

Objectives and Rationale Behind the Merger

The primary objectives of this amalgamation include:

- Operational Efficiency: Streamline operations, eliminate redundancy, and foster better resource utilization.

- Enhanced Capital Base: Pooling of resources will result in a stronger balance sheet and better capital adequacy.

- Wider Outreach: Unified branch network for improved rural penetration and financial inclusion.

- Technological Advancement: Integrated Core Banking Solution (CBS) and digital infrastructure to improve customer service.

Key Provisions and Operational Implications

1. Transfer of Assets and Liabilities

- All assets and liabilities of APGVB and CGGB stand transferred to APGB without any requirement of novation.

- No requirement for fresh documentation for ongoing customer relationships, credit facilities, or security documentation.

2. Continuity of Service

- All employees, officers, and managerial personnel of the existing banks shall continue in the new entity without any change in service terms.

- Union-related issues, if any, will be resolved as per standing orders and the RRB staff regulations.

3. Legal Proceedings and Contracts

- Any ongoing litigation, arbitration, or contractual obligations of erstwhile RRBs shall continue seamlessly with APGB substituted as a party.

- Pending DRT/DRAT cases or SARFAESI proceedings will automatically vest with the new entity.

Accounting and Compliance Considerations

1. Financial Statement Consolidation

- Consolidation of financials is mandatory under Accounting Standard (AS) 14 for amalgamations. Since this is a merger by pooling of interest, the pooling of interest method must be applied.

- Capital Reserve / Goodwill arising on amalgamation needs to be disclosed clearly.

2. Tax Implications

- Amalgamation of RRBs is tax neutral under Section 47 of the Income Tax Act, 1961, and does not attract capital gains.

- Carry forward of losses and unabsorbed depreciation is allowed under Section 72A subject to fulfillment of continuity of business conditions.

3. GST and TDS Compliance

- Change in GSTIN to be intimated to vendors and customers; input tax credit to be transferred via ITC-02 filing.

- New TAN and PAN application might be required if there is a change in the jurisdiction or entity structure.

Governance and Oversight

- The Board of Directors of the new bank will be reconstituted with representatives from Central Government, State Government, NABARD, RBI, and Sponsor Bank.

- The amalgamated entity will function under the oversight of the Ministry of Finance (Department of Financial Services) and report statutory compliance to the RBI.

Transition Management and Stakeholder Communication

- Customers will need clear communication about the merger to address concerns over account numbers, cheque books, IFSC codes, and service continuity.

- Issuance of fresh stationery (cheques, passbooks, letterheads) post-1st April 2024 is mandatory.

- Digital platforms (mobile banking, internet banking) must be updated and synchronized.

Benefits to Stakeholders

Customers:

- Access to a wider network of branches and digital services.

- Unified grievance redressal and improved customer support.

Employees:

- Broader career growth opportunities.

- Cross-functional training and skill upgradation.

Government and Regulators:

- Better financial stability and regulatory supervision.

- Efficient implementation of rural development schemes and DBT.

Conclusion

The amalgamation of Andhra Pradesh Grameena Vikas Bank and Chaitanya Godavari Grameena Bank into Andhra Pradesh Grameena Bank is a welcome step towards strengthening rural banking infrastructure. While it demands meticulous transition planning and regulatory compliance, it paves the way for an integrated, tech-driven rural banking ecosystem. For Chartered Accountants, this amalgamation offers multiple areas of professional involvement — from accounting to due diligence, from tax advisory to transition management.

As India continues to aim for financial inclusion and rural prosperity, such strategic consolidations in the banking sector will act as strong pillars supporting that vision.

Customer FAQ Sheet

1. What is the reason for the amalgamation of APGVB and CGGB?

The amalgamation is aimed at strengthening the rural banking system by enhancing operational efficiency, improving customer service, reducing duplication of resources, and expanding outreach through a consolidated branch network.

2. What is the name of the new bank formed?

The newly amalgamated entity is named Andhra Pradesh Grameena Bank (APGB).

3. Will my account number change after the merger?

In most cases, your account number will remain unchanged. However, in case of duplicate account numbers within merged branches, the bank may issue a new account number and will communicate it directly to you well in advance.

4. Do I need to update my cheque book and passbook?

Yes. Although old cheques will be honored for a limited period, you are advised to collect new cheque books and passbooks bearing the new bank’s name and logo from your branch at the earliest.

5. What will happen to my ATM/debit card?

Your existing card will continue to work for a specified period. You will be issued a new debit card from APGB, which you should activate and start using. Notifications will be sent by SMS or mail.

6. Will there be changes to the IFSC code and MICR code?

Yes. The IFSC and MICR codes are expected to be revised for certain branches. You will be informed of the updated codes. It is essential to update these codes for NEFT/RTGS/IMPS transactions and ECS mandates.

7. Do I need to inform my employer or business associates about the change in bank details?

Yes. If your account number or IFSC code changes, you must inform your employer, pension disbursing authority, or business associates to avoid delays in credit.

8. What happens to my existing loans, EMIs, and standing instructions?

All existing loan agreements, repayment schedules, EMIs, and standing instructions will continue without any interruption. No fresh documentation is required.

9. Will there be any change in interest rates on deposits or loans?

There will be no immediate change in interest rates. However, future revisions will be as per APGB’s policies, subject to RBI regulations.

10. Is there any impact on internet banking or mobile banking access?

Yes. You may be required to re-register for internet and mobile banking under the new APGB portal/app. Separate communication will be sent regarding login credentials and migration steps.

11. Are there any charges or fees I will incur due to the amalgamation?

No. The amalgamation does not impose any charges or penalties on customers.

12. Will my branch remain the same?

Yes. All existing branches will continue to function as part of APGB. There may be a rationalization of overlapping branches in future, and customers will be notified in advance.

13. Whom should I contact for any queries or complaints related to this transition?

You can reach out to your existing branch manager or call the APGB Customer Care Helpline at: 📞 Toll-Free: 1800-123-4567

📧 Email: customercare@apgb.in

14. Where can I find updates or notifications related to the amalgamation?

Please visit the official website: 🌐 www.apgb.in for regular updates, branch codes, downloadable forms, and FAQs.

15. How long will the transition period last?

The full transition including backend IT integration, customer communication, and issuance of new instruments may take up to 6–12 months. Your cooperation during this time is greatly appreciated.

📌 Important Reminder:

Keep your KYC details updated, and ensure your contact number and email are registered to receive timely notifications.

Leave a comment