Chhatrapati Sambhajinagar, Maharashtra –

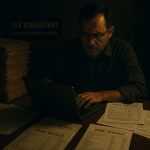

In a major enforcement action, authorities have booked a tax consultant for allegedly orchestrating a ₹73.63 lakh Goods and Services Tax (GST) fraud. The accused is suspected of misusing GST registrations and fabricating invoices to fraudulently claim Input Tax Credit (ITC).

The Allegations

According to officials, the consultant is accused of:

– Registering multiple GST accounts under different business names without legitimate operations.

– Generating fake invoices to inflate turnover and claim ITC without any actual movement of goods or services.

– Creating a network of fictitious firms to circulate invoices and conceal the fraudulent activity.

Investigation and Action

The Directorate General of GST Intelligence (DGGI) initiated the case after detecting anomalies during routine data analytics on GST returns.

Officials allege that the tax consultant’s modus operandi included:

– Using unsuspecting individuals’ documents for bogus GST registrations.

– Routing transactions through shell entities.

– Claiming ineligible ITC to offset tax liabilities.

An FIR has been registered under relevant sections of the GST Act and the Indian Penal Code (IPC) pertaining to cheating and forgery. The authorities are now tracing other possible beneficiaries and accomplices.

Implications for GST Compliance

This case serves as a stark reminder of the government’s increasing use of data analytics and AI tools to detect fraudulent GST activity.

Tax professionals and businesses are urged to:

– Ensure every GST registration is backed by genuine business activity.

– Maintain proper documentation for all transactions.

– Avoid engaging in ITC claims without clear evidence of goods/services movement.

Expert View

Tax experts note that the severity of penalties under GST law—including imprisonment for willful tax evasion exceeding ₹5 crore—means such cases will likely see swift prosecution.

“The GST regime is heavily data-driven. Any mismatches between invoices, e-way bills, and returns are instantly flagged. Fraudulent practices not only risk heavy penalties but can also lead to long-term professional blacklisting,” said a chartered accountant familiar with GST enforcement.

Key Facts

– Accused: Tax consultant from Chhatrapati Sambhajinagar.

– Alleged Fraud Amount: ₹73.63 lakh.

– Method: Fake invoices, bogus GST registrations, ineligible ITC claims.

– Action Taken: FIR lodged; investigation ongoing.

Takeaway

As GST compliance frameworks grow tighter, such incidents highlight the urgent need for ethical tax practices. Both professionals and businesses should prioritize transparency and accuracy in their filings to avoid severe legal and financial repercussions.

Leave a comment