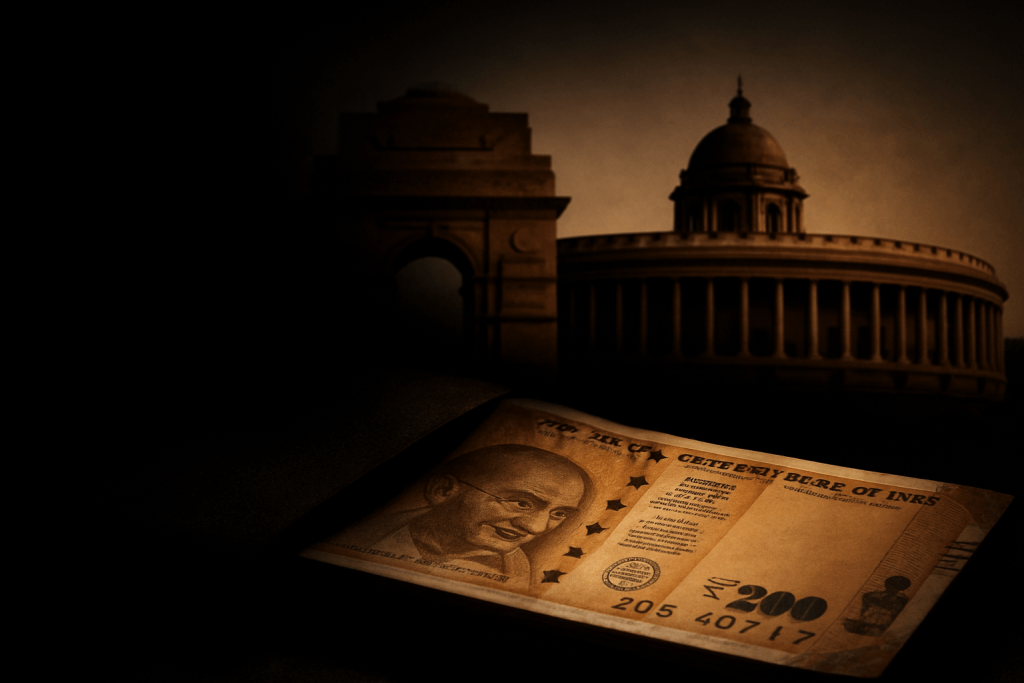

Black money has been one of the most debated and persistent challenges in India’s economy. It is often spoken about in news debates, political speeches, and even household discussions. But what exactly is black money, why does it exist, and how does it affect ordinary citizens? Let’s break this down in simple, professional terms.

What is Black Money?

In simple words, black money refers to income that is earned but not declared to tax authorities. Since it is not reported, no taxes are paid on it, making it “illegal” in nature. For example, if someone sells property but does not show the full value in documents to save on capital gains tax, the undeclared portion becomes black money. Similarly, cash payments without bills, underreporting of income, or money earned from corruption all add to black money.

Sources of Black Money in India

Black money does not come from a single source—it is generated through multiple channels:

1. Tax Evasion – Individuals or businesses hiding income to avoid paying income tax or GST.

2. Real Estate Transactions – Property deals often involve cash components that go unreported.

3. Corruption and Bribery – Money earned through illegal favors or misuse of authority.

4. Smuggling and Illegal Trade – Activities like hawala transactions and gold smuggling.

5. Overseas Accounts – Unreported money stashed abroad in tax havens.

Impact of Black Money on the Economy

The presence of black money doesn’t just affect the government’s tax revenue—it impacts every citizen:

– Loss of Revenue: When taxes are not paid, the government has fewer funds for infrastructure, healthcare, and education.

– Inflation: Black money often flows into luxury goods, real estate, and gold, pushing prices up.

– Unfair Competition: Honest taxpayers bear a heavier burden, while tax evaders gain unfair advantages.

– Corruption Cycle: Black money strengthens corruption, creating a cycle of distrust in governance.

– International Image: Countries with high levels of black money are seen as weak in governance, reducing investor confidence.

Measures Taken by the Government

India has introduced several reforms and measures to curb black money:

1. Demonetisation (2016): High-value notes of ₹500 and ₹1,000 were scrapped to flush out unaccounted cash.

2. Income Disclosure Schemes: Giving taxpayers a chance to declare hidden income by paying penalties.

3. Aadhaar-PAN Linking: Helps in tracking financial transactions more efficiently.

4. GST Implementation: Reduced cash dealings by bringing more transactions under a single tax system.

5. Digital Payments Push: Encouraging UPI, net banking, and card payments to reduce cash dependence.

6. Black Money (Undisclosed Foreign Income and Assets) Act, 2015: Strict penalties for those holding illegal overseas assets.

The Road Ahead

Despite efforts, black money continues to exist. The real solution lies in:

– Strengthening Tax Administration: Using AI and data analytics to track mismatches.

– Promoting Digital Economy: The less cash we use, the harder it is to hide transactions.

– Reducing Tax Burden: Simplified taxation can reduce the temptation to evade taxes.

– Public Awareness: People must understand that tax money funds schools, hospitals, and infrastructure.

Curbing black money is not just about government policies—it requires a mindset change among citizens to view tax compliance as a duty, not a burden.

FAQs on Black Money in India

Q1: Is black money always kept in cash?

A: No. While cash is common, black money can also be in the form of gold, property, or foreign bank accounts.

Q2: How does black money affect a salaried employee?

A: Salaried employees pay taxes regularly through TDS. But when others evade taxes, the government has less revenue, and the burden indirectly shifts to honest taxpayers.

Q3: Did demonetisation completely remove black money?

A: No. While demonetisation exposed some unaccounted cash, black money also exists in assets like property and gold, which were unaffected.

Q4: Can black money ever be fully eliminated?

A: It is difficult to eliminate completely, but with strict enforcement, technology, and a culture of tax honesty, it can be reduced significantly.

Q5: What role can citizens play in reducing black money?

A: Citizens should avoid cash-only deals, demand proper bills for purchases, and file honest tax returns.

Leave a comment