Cash may feel old‑school in our digital era, but ATMs remain a lifeline for many. Whether you’re getting started with a basic account or hold a premium card, it’s essential to know how much you can withdraw each day—and what happens if you pop into another bank’s ATM.

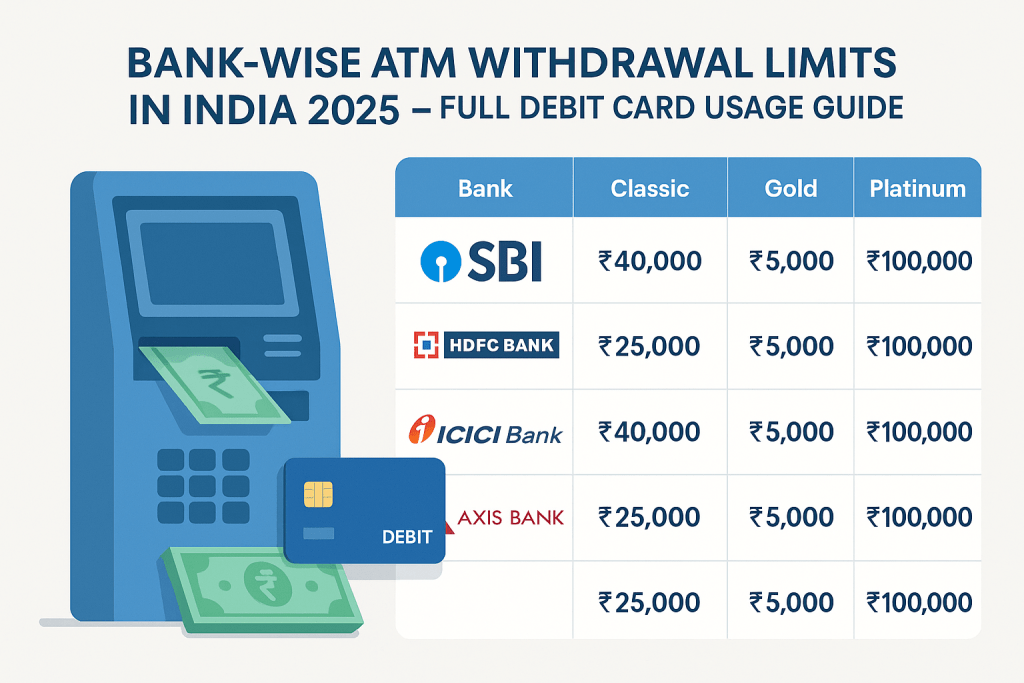

Daily Withdrawal Limits Vary by Bank & Card Type

- State Bank of India (SBI)

- Maestro / Classic / In Touch / SBI Go / Gold Debit Cards: ₹40,000/day

- Platinum International Debit Card: ₹100,000/day

- HDFC Bank

- International / Women’s Advantage / NRO: ₹25,000/day

- International Business / Titanium / Gold: ₹50,000/day

- Titanium Royale: ₹75,000/day

- Platinum / Imperia Platinum Chip: ₹100,000/day

- JetPrivilege HDFC World: ₹300,000/day

- ICICI Bank

- Coral Plus: ₹150,000/day

- Expression / Platinum / Titanium: ₹100,000/day

- Smart Shopper Silver: ₹50,000/day

- Sapphiro: ₹250,000/day

- Axis Bank

- RuPay Platinum / Power Salute: ₹40,000/day

- Liberty / Rewards‑type cards: ₹50,000/day

- Priority / Prestige / Value Plus / Delight: ₹100,000/day

- Burgundy: ₹300,000/day

- Bank of Baroda

- World Agniveer / RuPay Platinum / BPCL: ₹50,000/day

- Classic cards: ₹25,000/day

- RuPay Select: ₹150,000/day

- Union Bank of India

- Classic Visa/Mastercard/RuPay: ₹25,000/day

- Platinum / Signature / Business Platinum: ₹75,000 to ₹100,000/day

- Indian Bank

- PMJDY / Senior Citizen: ₹25,000/day

- RuPay Platinum / World / World Platinum: ₹50,000/day

- RuPay International Platinum: ₹100,000/day

- Punjab National Bank (PNB)

- Classic cards: ₹25,000/day

- Platinum / Visa Gold / Business Platinum NCMC: up to ₹150,000/day

- Federal Bank

- Contactless debit (FedFirst): ₹2,500/day

- RuPay Crown: ₹25,000/day

- Contactless premium cards: up to ₹100,000/day

- Kotak Mahindra Bank

- Junior: ₹5,000/day

- Classic One / RuPay: ₹10,000/day

- 811, Easy Pay: ₹25,000/day

- Silk Platinum, RuPay India: ₹40,000/day

- Access India: ₹75,000/day

- Privy League Platinum / World: ₹150,000–₹250,000/day

Using One Bank’s Debit Card at Another Bank’s ATM (Inter‑bank Usage)

Thanks to India’s National Financial Switch (NFS), most bank debit cards work at ATMs of other banks. Generally, you get 3–5 free ATM transactions per month, after which a nominal fee (around ₹20 + taxes) may apply per transaction. The withdrawal limit remains tied to your own bank’s policy, not the ATM owner’s.

Why Do Withdrawal Limits Exist?

1. Security – Limits help contain fraud or loss if your card is compromised.

2. Cash Management – ATMs stock limited funds, especially in remote locations.

3. Regulatory Guidelines – RBI mandates certain thresholds and free‑transaction policies.

Quick Reference Table

| Bank | Card Type / Tier | Daily ATM Limit (₹) |

| SBI | Classic / Maestro | 40,000 |

| SBI | Platinum International | 100,000 |

| HDFC Bank | Basic cards | 25,000–50,000 |

| HDFC Bank | Titanium / Platinum | 75,000–100,000 |

| HDFC Bank | JetPrivilege World | 300,000 |

| ICICI Bank | Coral Plus | 150,000 |

| ICICI Bank | Sapphiro | 250,000 |

| Axis Bank | Burgundy | 300,000 |

| Bank of Baroda | RuPay Select | 150,000 |

| Kotak Mahindra | Privy League Platinum+ | 150,000–250,000 |

| Union / Indian / PNB | Varies by tier | 25,000–150,000 |

FAQs

- Q: Can I withdraw more after reaching my daily limit?

A: No. Most ATMs will reject further cash withdrawal attempts once your daily cap is reached.

- Q: Do withdrawal limits at ATMs reset daily?

A: Yes—they typically reset after midnight as per your bank’s definition.

- Q: Can I withdraw more if I go to my bank’s branch counter?

A: In many cases, yes—branch counters often have separate or higher withdrawal limits, subject to documentation.

- Q: If I exceed free transactions at another bank’s ATM, what’s the cost?

A: Usually around ₹20 (plus taxes) per extra transaction, depending on your bank’s policy.

- Q: How can I find the exact daily limit for my specific debit card?

A: Check your bank’s official website or mobile app, or contact customer support.

Final Takeaway

Understanding your debit card’s ATM withdrawal limits—both for your own bank’s ATMs and others—is essential for smooth, fee‑free access to cash. While basic cards usually offer ₹10,000–₹50,000/day, premium or privilege cards can extend that significantly.

Leave a comment